DÉJÀ VU…

THE END OF THE PORTUGUESE GOLDEN VISA…again?

It feels like ground hog day (or week) writing this…

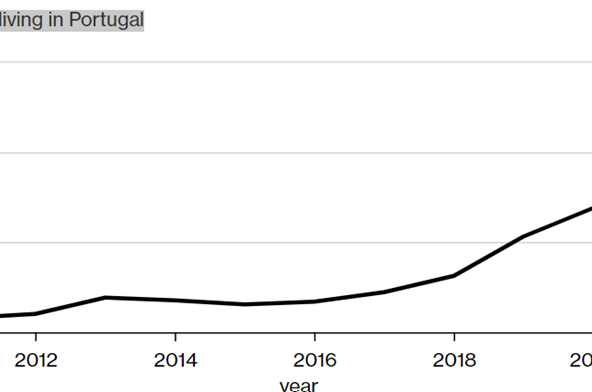

In September of 2022, I penned a 3-part article that can be found here: The changing portuguese real estate market ( Part 3 ) – ALL ABOUT RETIREMENT OVERSEAS, analysing the factors that had contributed to the change in the real estate landscape. I also pointed out the need for structural change in Portugal’s development landscape to allow for more, and more affordable, product, to make its way to the market.

In November 2022, in an article that can be found here: The End of the Portuguese Golden Visa?, I referenced the Portuguese Prime Minister’s comments at the 2023 Web Summit. António Costa threw the cat among the pigeons by stating the Golden Visa program probably did not justify being retained.

The ensuing debate was emotive and every participant (including yours truly) had an opinion. As I have repeated many times, any statement by a senior Portuguese figure is usually a precursor to action. A proposal may undergo adjustment prior to implementation but it is usually an indication of intent.

Thus it is not surprising that a few months after Parliament voted against changes to the GV program, the same proposal is now back on the table. Except much broader and more severe.

Why is this happening now?

The Golden Visa program has become (rightly or wrongly) associated with the “ills” that have affected the real estate market. Three factors stand out:

- Properties have become unaffordable to many local residents, in particular the younger generation

- With GV requiring such short stays, most properties have made their way to the short-term local lodging (AL) market that has displaced local residents and changed the characteristics of entire neighborhoods. As a result, the number of residential rentals has diminished

- The EU has been fighting against GV programs for some time, claiming they contribute to money laundering and possibly even to allowing the entry of terrorists into the Schengen area, and it might just be time to concede on this point

However, the government has not limited its proposals to the Golden Visa program.

A summary of the proposed changes

Much has been written about the proposed changes. For the moment, nothing is certain. The public consultation period runs for one month, to March 16th, 2023. Legislation could theoretically be implemented by decree. Even with resistance in parliament, the government has a majority, so can push changes through by itself.

The changes proposed include (the list is limited to those most likely to impact international investors and future residents):

- New real estate Golden Visas will no longer be allowed, of any type, anywhere

- Golden Visa renewals will come with conditions. Applicants and GV holders will be required to either make their property their primary residence or to ensure it is placed on the long-term rentals market. Those conditions are substantially different to the original conditions that were part of the GV program

- Incentives for transferring properties from short-term rental (local lodging or AL) to long-term rental (arrendamento)

- Compulsory rental of empty properties

- Rent control/caps

- The government will in some cases become the tenant with the right to sublease

- Penalties for planning delays

- Elimination of early repayment penalties on mortgage balances

Although a few positive measures have been proposed, they have been drowned out in the wave of uncertainty and by protests about the proposed changes. The general consensus from across almost all sectors of society, civil and professional, is that the government will never be able to implement all its proposals as some are not constitutional. I am neither a lawyer nor a constitutional expert, so I will simply point out the areas that appear to be most problematic:

- Appropriating vacant properties and forcing them onto the long-term lettings market

- Changing the terms under which original GV were granted, specifically in relation to the renewals. Most GV applicants chose the Portuguese GV program because of its low-stay requirements. Therefore, expecting that GV applicants make the property they have purchased (ignoring for the moment that some may not be suitable for permanent habitation) is unrealistic, and so the only option available under the proposed changes is to place the property on the long-term rental market

- Providing tax incentives for those moving from short to long-term lets, but excluding any rentals to immigrants (will an immigrant therefore be charged 25% more than a “local”, and indeed after how many months in the country, if ever, does an immigrant become “local” resident?)

- The government appointing itself as the tenant, with the right to sublet (a practice not common in Portugal) and with a government that is generally slow to pay

- Ongoing rent caps, contrary to the principle of an open market and freedom of use of private property

- Forcing Golden Visa investors to link renewals to a change in the use of their property to long-term rentals, in situations where the purchase is done in a project or condominium which is specifically zoned for tourism, for example, seems contradictory and difficult to implement given the legal classification of the property

The debate on social media, portals and discussion forums already includes threats by individuals or groups of individuals, to take the government to court if it proceeds with some of its proposals.

Practical steps that can be taken now

Among the uncertainty, most professionals and advisors are advising caution. That is fair, especially as a large part of the content of this article may change within weeks. However, there are some practical steps that appear sensible, low or relatively low risk, and that make the most of the changes. Some examples:

- Paying down mortgages: with increasing interest rates, anyone with capital in Portugal can reduce uncertainty and avoid early repayment fees, that have now been waived. For Portuguese citizens and residents who have some savings, do not have international investments, and are relying on paltry savings rates offered by local banks, the decision seems a “no-brainer” in most cases

- Switch on some utilities: to ensure that your property is not considered vacant, it seems as though the government will want to see evidence of some services being delivered within the previous 12 months

- Moving property into the long-term rental/letting market: generally, with the demand for long-term rental properties increasing due to residency visa programs such as the D7 (passive income or retirement) and D8 (digital nomad), and with the proposed special tax payable by AL owners, the proposed end of AL by 2030, and the tax exemption offered to those who move from AL to long-term rentals, there has never been a better time to start planning the move

- For existing GV investors, improving the chances of a Golden Visa renewal under new proposals: with the government progressively encouraging a move from short to long-term rentals, getting on a recognized long term lettings program is essential. A lot of people are talking about potential legal challenges if the government ploughs ahead with some of its proposals. But legal action can be time-consuming. Protecting income streams and asset value, together with guaranteeing residency, should be accomplished first.

Ignoring the history of policy-making in Portugal is risky. When a senior political figure makes an announcement or a prediction of this type, change is usually inevitable. It does not mean that the changes will be implemented exactly in the manner of the original announcement, but it is an early warning that changes will happen.

Most of the proposals are likely to be implemented, to a greater or lesser degree.

We observe government already providing some solutions to the challenges it has created with its own proposal. An example is the proposed 7-year tax exemption (until 2030) on income for owners who move from AL or local lodging, to arrendamento or long-term lets.

Based on past experience of other programs such as the NHR regime, that lasted 10 years at 0% tax before being changed, it is likely that within the 7 years the zero-tax position will erode. Acting swiftly to ensure a degree of certainty in a continuously changing fiscal landscape, is crucial. Also, expect many exceptions to the rule.

For new applicants, what is the alternative to the Golden Visa?

Portugal needs to attract more permanent residents who contribute directly to the local economy by spending on local services, and who pay their tax locally (by becoming tax residents).

Portugal has a residency visa known as the D7, for applicants with a passive income. Recently, digital nomads may apply for residency via the D8 visa.

The D7 and D8 visas are more flexible than the Golden Visa in that applicants can rent or buy a property. There are no geographic restrictions or minimum value. Conversely, applicants must live in the country for, on average, more than half a year, each year. The GV only requires an average of 7 days per annum.

Disclaimer: expect some of this to be outdated by the time it is published, and when seeking advice from duly qualified professionals on the changes, don’t rely on one single “expert” – consult or poll several!