I have yet to meet a person who does not wish to put 2020 behind them. In fact, I recall a post from the son of one of our friends, a young man in his early twenties, who was able to take one memorable overseas trip, and explore his own country, as the single spontaneously optimistic write-up of 2020 that I have read. So it is natural that all of us are looking for positive news at the end of a difficult year. And none more so than those who are hoping for better news from the overseas property market.

Many of those who work in market sectors linked to international retirement migration, immigration, investment or real estate, as well as those who must interact with real estate for residential or investment purposes, are aware of the complexities when dealing with real estate overseas.

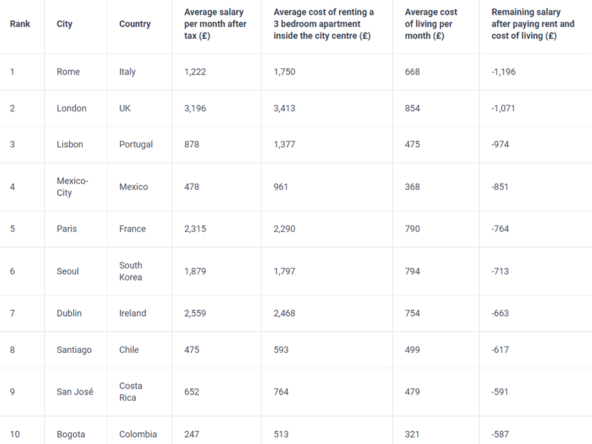

Portugal’s attractiveness as a retirement, work and investment destination has grown exponentially in the last few years. Although new investment and construction have been negatively affected by the Covid-19 pandemic and its near-annihilation of the tourism market (in particular short-term tourism market), demand for property in Portugal, whether to buy or rent, continues to grow. Data published by the Instituto Nacional de Estatísticas shows that after a dip in sales caused by the pandemic, sales recovered to €6.8 billion in Q3 of 2020. The Lisbon metropolitan area and the Algarve were the only two regions where the value of the transactions, as a percentage of total, were greater than their market share based on number of sales alone (for example, Lisbon represented 31.3% of the sales but 43.4% of the value, and the Algarve, 7.3% and 10.7%, respectively).

The variance in the numbers, together with the influence of the Golden Visa on property values in the area, do suggest the need for some caution when buying in the greater Lisbon region.

Although the volume of sales has rebounded, the average time to complete a sale, according to Idealista, has increased in all the major regions. Lisbon is up by 10 days to 4.1 months, Porto by 20 days to 4.2 months, and the Algarve up 50 days to 6.4 months.

A move from residence by investment to permanent residence via proof of income

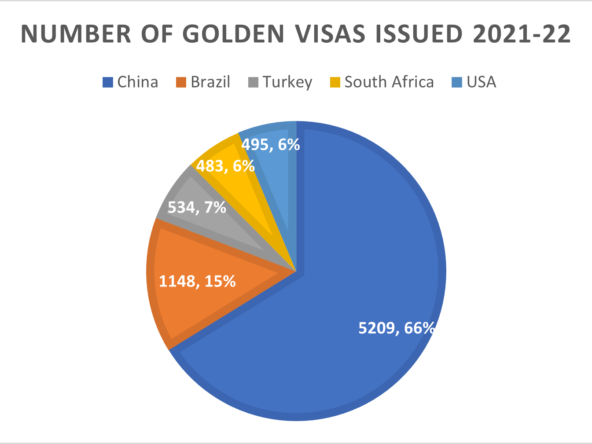

Portugal’s Golden Visa, or residence by investment, program, worth around €6 billion to the Portuguese economy, has been spurred on by investors who have not sought to make their Portugal their real home. Rather Chinese, Russian, Turkish, Brazilian and South African buyers have used the minimum stay requirements to obtain their residency. Clearly the main beneficiaries of this wave of investment have been the government and developers, but historical city areas, and those zones awaiting much-needed gentrification have seen their reputation and value increase substantially as a result of the investment that has been channeled into the areas. At a time when tourism was booming and demand for short-term accommodation was growing at a fast pace, the wave of investment purchases was in synch with the demand of a world enamored with Portugal as a tourism destination.

The first signs of a mismatch between supply and demand was reflected in the government’s decision to authorize local authorities to limit the issuing of new local lodging licenses for historical city centers. Then came Covid-19. The world changed in the space of months. The Coronavirus pandemic delayed, but did not halt, the government’s decision to curtain the Golden Visa’s eligible areas.

The government’s proposed changes to the Golden Visa program included excluding high density areas from the program by mid-2021. Previously approved Golden Visas, and renewals, will remain unaffected.

The precise changes are not yet known, with the strong construction industry continuing to call for an alteration but not a total removal, of the Golden Visa program, from the coastal areas (where the highest number of high-density municipalities are concentrated). It is easy to understand why there is a strong lobby by this sector, because a survey by APPII – the Portuguese association of promoters and real estate investors, among its 200 members who jointly represent investment in the order of magnitude of €200 billion, showed that 95% of respondents intend to invest in the residential sector and 100% in coastal areas!

There is some apparent willingness of developers to consider limited future inland investment, but real estate investment continues to be concentrated in areas around the two metropolitan hubs of greater Lisbon and Porto, and this trend shows no likelihood of change.

Most interesting is that even the country’s most popular tourism destination, the Algarve, is planned to attract only 18% of future investment, something that indicates that values in that region are likely to continue to demonstrate an upward trend and FDI into the real estate sector remains limited.

It is still unclear whether the Algarve low-density coastal areas, among the only in the country, will remain eligible as Golden Visa municipalities (legally, the most logical conclusion as they need the investment as much as any other low-density inland area) or will be eliminated by virtue of being on the coast. At the time of writing the final diploma covering the decisions of the ministerial meeting held on December 22, 2020, had not yet been published, so this aspect remains to be defined.

If so, it can be expected that investors may well turn their attention to this region of the country, which combines the benefit of the region’s premier tourist destination with access to the coastline and a wonderful lifestyle and lower cost of living than the metropolitan area of Lisbon.

The emergence of the D7 visa as an alternative to the Golden Visa

An expected consequence of the increase in Portugal’s popularity as a destination was the increase in demand for permanent accommodation, whether rented or purchased. Therefore, rather than buy a property and have to adhere to strict minimum investment levels imposed the Golden Visa program, which was undergoing change, the “D” visas, including D7 for retirees and D2 for entrepreneurs, have started to emerge as the preferred route to residency for many. The general principle is that these visas demand that the applicant has the ability to prove sufficient proof of income. It appears to be the fastest-growing residency visa for Portugal.

One advantage of the D7 visa is that it does not require a purchase but can be obtained via a suitable long-term rental contract.

Finally, the elimination of one of the most unfair pieces of legislation in Portugal

The Portuguese understand that they have one of the highest and unfairest tax burdens in Europe. Whether import duties considered illegal by the EU and which has made the country the recipient of fines and countermeasures; fuel duties; among the largest personal tax burdens in the OECD; or the high rate of VAT (on top of the high personal tax rate), the Portuguese have for long reacted to their lot in life with a degree of acceptance and resignation.

The Portuguese government has a long track record of targeting immovable assets as an easy way to collect taxes. As an example of this unequal treatment, capital gains tax (CGT) was applied to real estate while the sale of shares was exempt (only recently changed).

But the situation was even worse: since the introduction of the local lodging legislation (Alojamento Local or AL), the thousands of registered owners have been subject to a theoretical CGT on the “presumed sale” of their asset if they were to register and subsequently deregister their property from the AL regime. A consequence practically never mentioned by the many accountants, wealth management and other firms who earned a lot of money from helping owners become compliant by registering for AL, all owners risked receiving a bill from the government if they decided to deregister from AL. Because home ownership, including long-term rental income, is in a different category from AL, which is considered a business activity, any loss that may have occurred when the property was placed into AL, was not recoverable nor could it be offset against the “Theoretical gain”.

This aberration of a law was finally removed from the statute books in the latest Budget, bringing an end to what must surely constitute one of the most unconstitutional pieces of legislation on record. Owners may now deregister, should they wish, from the AL regime, without having to pay any CGT until they actually sell their property. As always, some attention and care are necessary, with a minimum period of ownership post-deregistration required, in order to benefit from the application of CGT on 50% (rather than 95%) of the gains (this for residents).

It is hoped that this will be one of many steps to improve the long-standing tradition of tax discrimination against property ownership, which has historically been an easy form of taxation.

Working with someone who represents your interests, even at a distance

Given the times in which we are living, it seems practical to start the process of a move to, or an investment in, Portugal, from a distance. Working with a local expert, knowledgeable in multiple disciplines and with a broad network of expert partners, will make the process much easier.

We have made available different resources to assist clients with their process:

- For those interested in retirement in Portugal, algarveseniorliving.com is a good source of information

- If you want to start with a rental to allow you time to research your options, or if renting is your long-term plan, then algarvelonglets.com provides an example of a regional rental portfolio (in the Algarve)

- For all those unable to travel, and who need someone to be their eyes and ears on the ground, acting for you, the buyer or tenant, consider the finder agent model explained at propertyfinderportugal.com. US and Canadian clients will recognize the model as similar to the MLS back home

- Those seeking an exclusive 5* retirement community in a top coastal location, visit luz-living.com

Contact details:

+1 305 424 8869

+44 208 144 7558

+351 965 683 054

info@algarveseniorliving.com